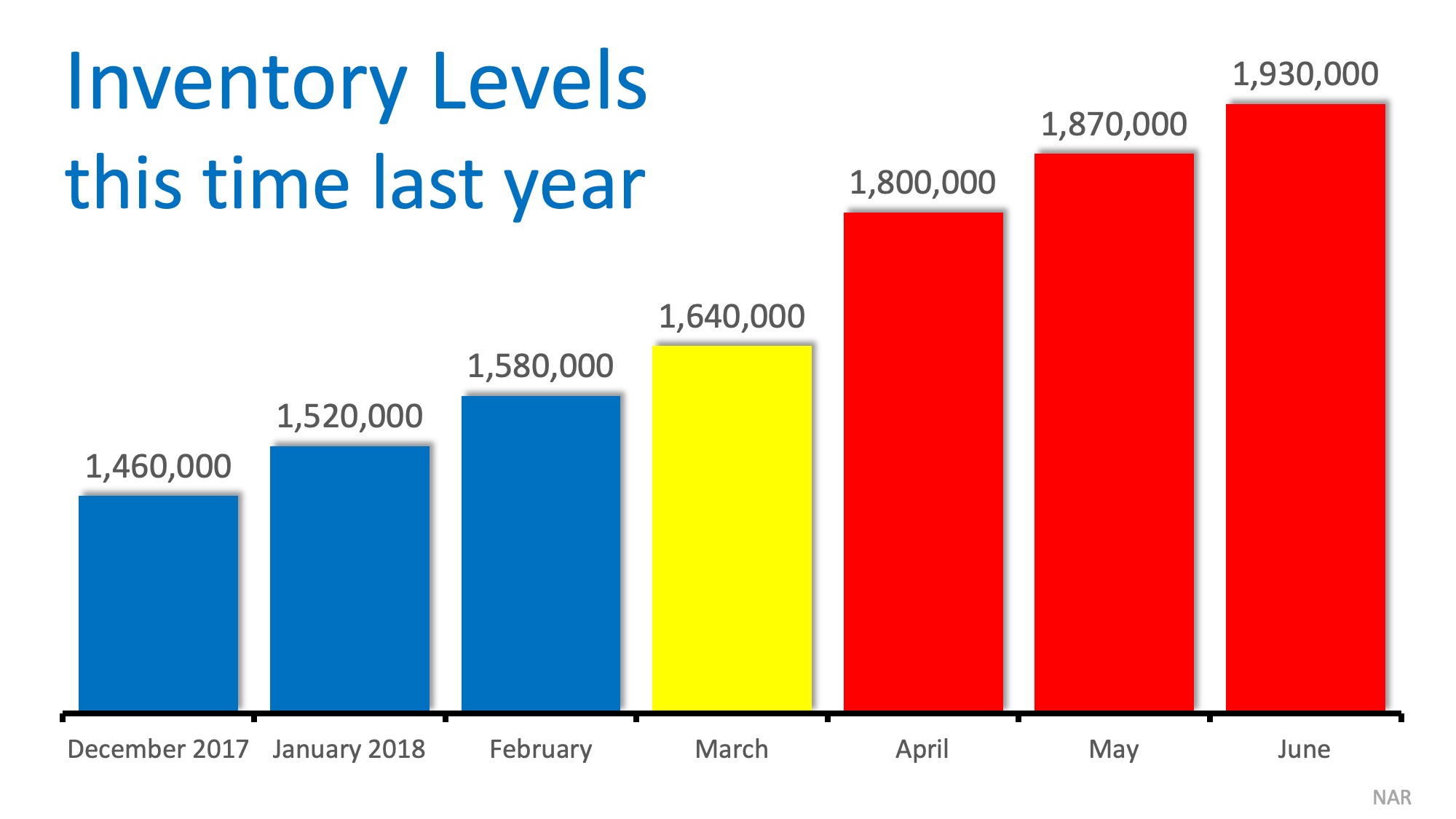

The lack of existing inventory for sale has forced many homebuyers to begin looking at new construction. When you buy a newly constructed home instead of an existing home, there are many extra steps that must take place.

To ensure a hassle-free process, here are 5 tips to keep in mind if you are considering new construction:

1. Hire an Inspector

Despite the fact that builders must comply with town and city regulations, a home inspector will have your best interests in mind! When buying new construction, you will have between 1-3 inspections, depending on your preference (the foundation inspection, the pre-drywall inspection, and a final inspection).

These inspections are important because the inspector will often notice something that the builder missed. If possible, attend the inspection so that you can ask questions about your new home and make sure the builder fixes any problems found by the inspector.

2. Maintain good communication with your builder

Starting with the pre-construction meeting (where you will go over all the details of your home with your project manager), establish a line of communication. For example, will the builder email you every Friday with progress updates? If you are an out-of-state buyer, will you receive weekly pictures of the progress via email? Can you call the builder and if so, how often? How often can you visit the site?

3. Look for builder’s incentives

The good thing about buying a new home is that you can add the countertop you need, the mudroom you want, or an extra porch off the back of your home! However, there is always a price for such additions, and they add up quickly!

Some builders offer incentives that can help reduce the amount you spend on your home. Do your homework and see what sort of incentives the builders in your area are offering.

4. Schedule extra time into the process

There are many things that can impact the progress on your home. One of these things is the weather, especially if you are building in the fall and winter. Rain can delay the pouring of a foundation as well as other necessary steps at the beginning of construction, while snow can freeze pipes and slow your timeline.

Most builders already have a one-to-two-week buffer added into their timelines, but if you are also in the process of selling your current home, you must keep that in mind! Nobody wants to be between homes for a couple of weeks.

5. Visit the site often

As we mentioned earlier, be sure to schedule time with your project manager at least once a week to see the progress on your home. It’s easy for someone who is not there all the time to notice little details that the builder may have forgotten or overlooked. Additionally, don’t forget to take pictures! You might need them later to see exactly where that pipe is or where those electrical connections are once they’re covered up with drywall!

Bottom Line

Watching your home come to life is a wonderful experience that can sometimes come with hassles. To avoid some of these headaches, keep these tips in mind!

If you are ready to put your current home on the market and find out what new construction is available in your area, let’s get together to discuss your options!

![Home Prices Up 6.34% Across the Country! [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2018/11/28140426/20181130-STM-ENG.jpg)

![VA Home Loans by the Numbers [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2018/11/05170644/20181109-Share-STM.jpg)

![VA Home Loans by the Numbers [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2018/11/05170545/20181109-STM-ENG.jpg)