In today’s fast-paced world where answers are a Google search away, there are some who may wonder what the benefits of hiring a real estate professional to help them in their home search are. The truth is, the addition of more information causes more confusion.

Shows like Property Brothers, Fixer Upper, and dozens more on HGTV have given many a false sense of what it’s like to buy and sell a home.

Now more than ever, you need an expert on your side who is going to guide you toward your dreams and not let anything get in the way of achieving them. Buying and/or selling a home is definitely not something you want to DIY (Do It Yourself)!

Here are just some of the reasons you need a real estate professional in your corner:

There’s more to real estate than finding a house you like online!

There are over 230 possible steps that need to take place during every successful real estate transaction. Don’t you want someone who has been there before, someone who knows what these actions are, to ensure you achieve your dream?

You Need a Skilled Negotiator

In today’s market, hiring a talented negotiator could save you thousands, perhaps tens of thousands of dollars. Each step of the way – from the original offer, to the possible renegotiation of that offer after a home inspection, to the possible cancellation of the deal based on a troubled appraisal – you need someone who can keep the deal together until it closes.

What is the home you’re buying or selling worth in today’s market?

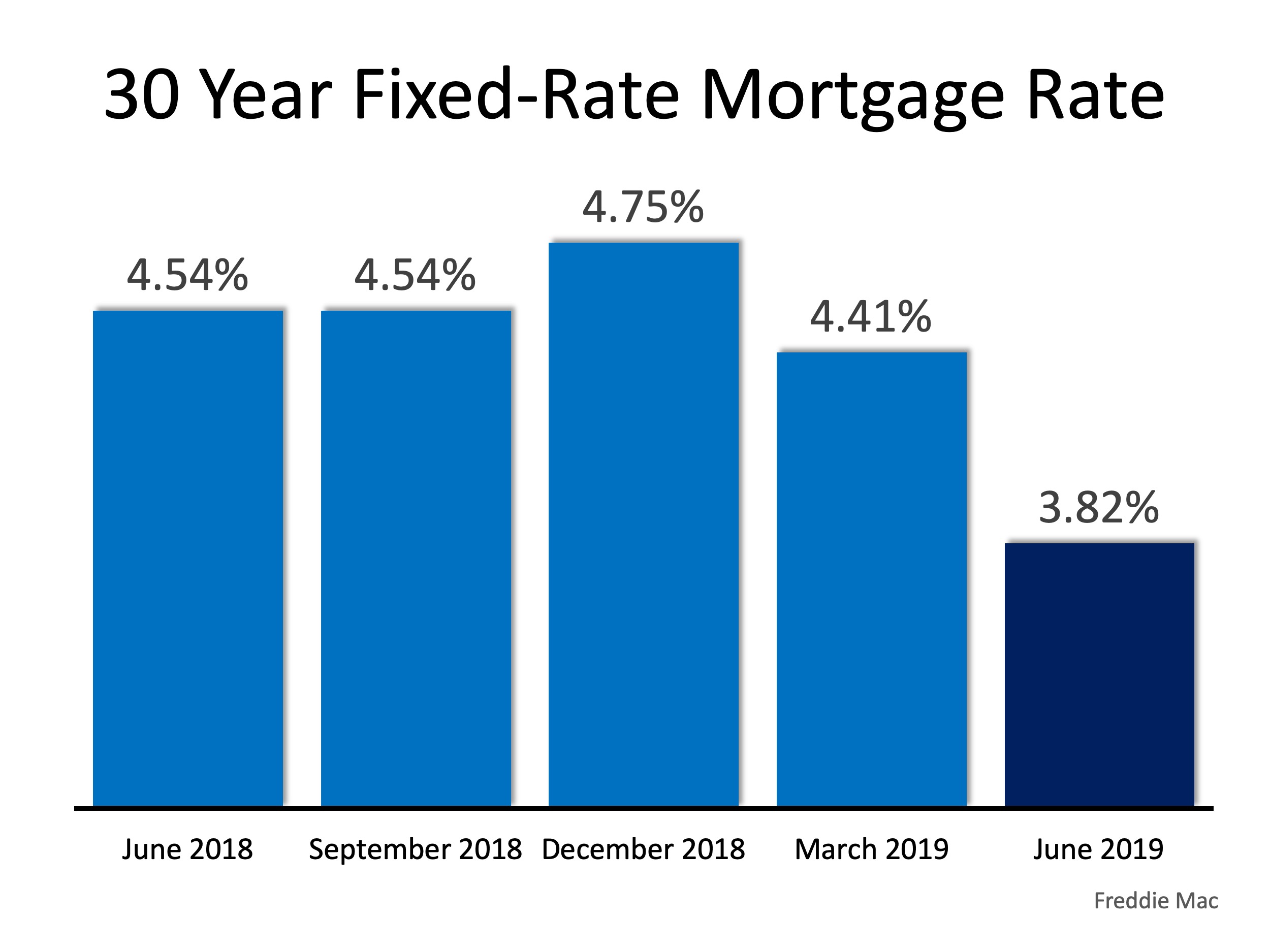

There is so much information on the news and on the Internet about home sales, prices, and mortgage rates; how do you know what’s going on specifically in your area? Who do you turn to in order to competitively and correctly price your home at the beginning of the selling process? How do you know what to offer on your dream home without paying too much, or offending the seller with a lowball offer?

Dave Ramsey, the financial guru, advises:

“When getting help with money, whether it’s insurance, real estate or investments, you should always look for someone with the heart of a teacher, not the heart of a salesman.”

Hiring an agent who has his or her finger on the pulse of the market will make your buying or selling experience an educated one. You need someone who is going to tell you the truth, not just what they think you want to hear.

Bottom Line

Today’s real estate market is highly competitive. Having a professional who’s been there before to guide you through the process is a simple step that will give you a huge advantage!

![4 Reasons to Sell this Summer [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2019/06/03172401/20190621-Share-KCM-Image-571x300.jpg)

![4 Reasons to Sell this Summer [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2019/06/03172248/20190621-MEM.jpg)

![Top 4 Renovations for the Greatest Return on Investment! [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2019/06/03162625/20190614-Share-KCM-571x300.jpg)

![Top 4 Renovations for the Greatest Return on Investment! [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2019/06/03162508/20190614-MEM.jpg)